Impact of Rising Interest Rates on Prescribed Rate Loans

In a previous article, we had discussed the benefits of implementing a prescribed rate loan to lower your family’s tax burden. This strategy allows a taxpayer to shift investment income realized on public company securities to a spouse, children or grandchildren. This strategy is implemented either between two individuals or through an intervivos family trust.

You can read more on the overall strategy and its potential benefits in our previous article (HWLLP » Lower Your Family’s Tax Burden With A Prescribed Rate Loan – HWLLP).

The prescribed rate loan strategy requires that the interest payable on the loan is equal to the Canada Revenue Agency (CRA’s) prescribed interest rate at the time the loan is made. Prescribed rate loans remain constant at the prescribed rate when the loan was first established. Since our first article was posted, the CRA has increased the prescribed rate from 1% to 2% for loans made between July 1, 2022 and September 30, 2022.

With a further increase to 3% to be effective October 1st, 2022. This means that existing prescribed rate loans established when the prescribed rate was 1% will remain at the same rate of interest, while newly established loan will have interest payable at 2% or 3%, depending on the date it was made. This increase in interest rates reduces the attractiveness of prescribed rate loans given the higher interest costs incurred on the loan.

With the rising interest rates, the timing of the interest payments becomes even more important. The interest on the loan must be paid by January 30th to maintain the integrity of the planning. A loan established at the higher prescribed rate of 2% brings with it a larger interest payment that must be planned for and executed by this deadline.

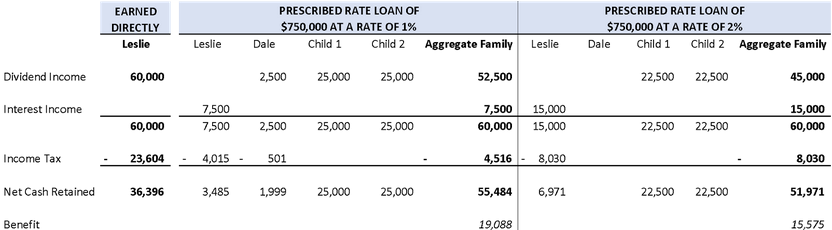

Consider the following scenario for illustrative purposes:

This scenario demonstrates the same information as in our previous article but highlights the difference in benefits gained when the prescribed interest rate rises.

Leslie and Dale are married and have three children. Leslie earns $330,000 of employment income each year. Dale’s income is less consistent, and generally earns $30,000 on average. Leslie and Dale’s two oldest children are enrolled in post secondary education and have no income. Leslie and Dale are assisting the children with their education, cost approximately $25,000, per child, each year.

Leslie has $750,000 of cash available to earn passive investment income. Assume an annual rate of return on investment of 8%, or $60,000 in 2021. For simplicity’s sake, let’s assume the character of the income earned is public company dividends.

Even in the higher prescribed rate loan scenario, the family saves approximately $15,500 per year by holding the investments in a trust and distributing the income among the family members. However, the benefit of such planning is diminished if the interest rates increase and a higher rate of return on the investments cannot be obtained.

Contact Us

If you are interested in this type of planning, we would be pleased to review your situation to determine its merit in your specific circumstances and to tailor and implement this strategy to benefit you and your family.

Give us a call for more information about this article at (613) 235-2000 or send an email to info@hwllp.ca